EU–US Trade Update 2025

US–EU Tariff Escalation

On April 2, 2025, U.S. President Donald Trump announced the introduction of new tariffs, including a 25% tariff on steel and aluminum imports from the EU, along with a 20% tariff on all European goods, including automobiles. While AGRIWELL does not currently export to the United States, these developments reflect the shifting dynamics of global trade and the potential challenges EU-based exporters may face in the evolving regulatory landscape.

Previous Tariff Rates

Prior to these changes, the EU and the U.S. had established tariff rates under various agreements. For many agricultural products, tariffs ranged from 0% to 10%, depending on the specific commodity and existing trade agreements. Certain grains and oilseeds were subject to minimal tariffs, facilitating relatively free trade between the regions.

Timeline of Tariff Changes

Before February 2025: Trade between the EU and the U.S. benefited from low or zero tariffs for many product categories.

February 26, 2025: President Trump signaled plans to impose a 25% tariff on EU imports, citing trade imbalances.

April 2, 2025: Official announcement of new tariff structure:

April 5, 2025: A universal 10% tariff imposed on all imports to the U.S. from countries not granted special treatment.

April 9, 2025: A country-specific 20% tariff applied to goods from the European Union, replacing the general 10% rate for EU-origin goods.

Effective Tariff for EU Exports

As of April 9, 2025, all goods exported from the EU to the U.S. are subject to a single tariff of 20%. This special rate replaces the general 10% tariff that applies to other countries, meaning EU goods are taxed at a flat 20% rate upon entry into the U.S.

Agricultural Trade Statistics: EU to U.S.

Even though AGRIWELL is not active in the U.S. market, understanding the scale of EU exports provides valuable context:

2023: EU agri-food exports to the U.S. totaled €27.18 billion.

2024: This figure increased to €28.7 billion, indicating strong growth despite early signs of tariff threats.

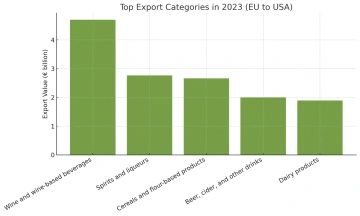

Top Export Categories in 2023:

Wine and wine-based beverages: €4.7 billion (17.3%)

Spirits and liqueurs: €2.76 billion (10.1%)

Cereals and flour-based products: €2.66 billion (9.8%)

Beer, cider, and other drinks: €2.0 billion (7.3%)

Dairy products: €1.89 billion (6.9%)

Monthly Export Highlights in 2024:

April 2024: €19.8 billion (10% increase YoY)

July 2024: €20.8 billion (15% increase YoY)

Trade Balance: From January to July 2024, the EU’s agri-food trade surplus reached €39.7 billion, up €1.1 billion from the same period in 2023.

EU Retaliation and Strategic Countermeasures

In response, the EU proposed a "zero-for-zero" agreement to eliminate industrial tariffs on both sides. However, President Trump rejected the proposal, claiming it wasn’t sufficient to address the US trade deficit with the EU.

The European Commission is now preparing retaliatory measures, including tariffs on American products such as steel, aluminum, and various industrial and agricultural goods. These countermeasures are expected to take effect on May 15, 2025.

At the same time, the EU is considering additional steps, such as a digital services tax targeting US tech giants including Google, Amazon, Facebook, Apple, and Microsoft (The Register, April 7, 2025).

This escalation has raised concerns about the potential negative impact on the global economy, with trade chambers and economists warning of a possible recession.

Both sides have expressed willingness to negotiate, but current actions suggest ongoing tensions in transatlantic trade relations.

Broader Considerations for AGRIWELL

While AGRIWELL is not impacted directly by the new U.S. tariffs, this development underscores the need to remain agile in international markets. Trade policies can shift rapidly, and being prepared for similar changes in other regions.

Monitoring global trade trends, strengthening relationships with existing markets, and evaluating new trade routes will help safeguard AGRIWELL’s strategic interests in an increasingly unpredictable economic climate.

Conclusion

This escalation has raised concerns about the potential negative impact on the global economy, with trade chambers and economists warning of a possible recession.

Both sides have expressed willingness to negotiate, but current actions suggest ongoing tensions in transatlantic trade relations.