Ukraine has reduced sunflower oil exports to the lowest level since 2016

According to data as of March 1, 2025, sunflower oil exports from Ukraine in the 2024/25 marketing year decreased by 24%, compared to the same period of the previous season, reaching 2.4 million tons. This is the lowest figure for this period since the 2016/17 marketing year, according to the Ukrainian Grain Association.

Main Markets and Changes in Export Geography

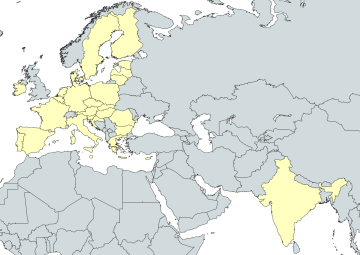

Despite the overall decline in volumes, the EU remains the primary buyer of Ukrainian sunflower oil, accounting for 54% of total exports. For the first time in three seasons, India became the leading importer, purchasing 417 thousand tons, which is five times higher than in the same period of the previous year.

MAIN MARKETS

February Decline and Reasons for Weak Exports

In February, sunflower oil exports decreased by 14% compared to January, reaching 325 thousand tons, which is the lowest level for this month in the past 10 years, according to data from the Ministry of Agrarian Policy and Food of Ukraine.

One of the reasons for the decline in volumes was the limited supply of raw materials for processing enterprises, which led to a decrease in processing margins to zero or even negative values amid unstable prices.

Price Dynamics and the Impact of Global Markets

Over the past week, demand prices for sunflower oil in Ukraine dropped by $5–10 per ton, reaching $1,110–1,115 per ton with delivery to Black Sea ports. This decline was driven by falling prices for palm and soybean oils, as well as decreasing oil price quotations.

Despite unfavorable conditions, Ukrainian processors continue to maintain purchase prices for sunflower seeds (with 50% oil content) at $644–665 per ton with delivery to processing plants, hoping for a potential price increase in the second half of the season.

Market Outlook

In the coming months, an increase in sunflower oil supply from Argentina is expected, which could meet the needs of key importers, including India, and limit the potential for price growth. Additionally, the United States Department of Agriculture (USDA) is expected to update global balance sheets, where adjustments to forecasts for demand and vegetable oil stocks may be introduced (source: USDA).